Morningstar, which has its headquarters in Chicago, Illinois, provides financial data for more than 400,000 potential investments, which include stocks and mutual funds. In addition, real time data is available for over 9 million equities, futures, options, indexes and commodities, as well as precious metals, foreign exchange and treasury markets.

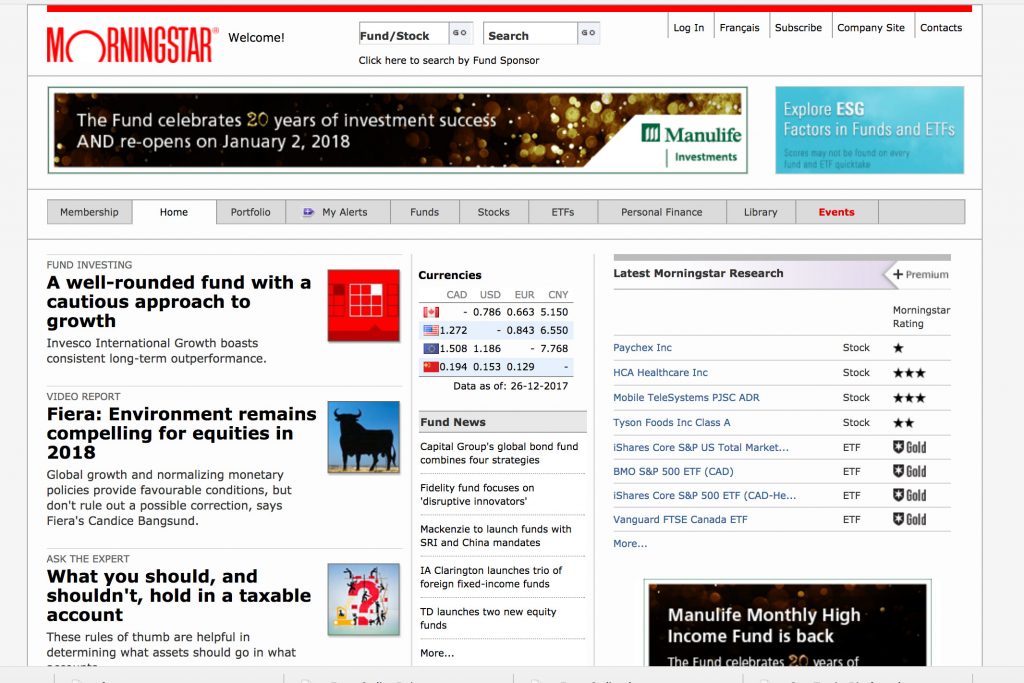

Morningstar is perhaps best known for creating the Morningstar Rating and the Morningstar Style Box.

The Morningstar Rating is a star rating system that allocates between one and five stars to a stock, and indicates Morningstar’s view of whether a stock is either over or under valued. Stock ratings are calculated each day. Ratings are also applied to funds in the same manner, and this is done on a purely quantitative basis as a backward looking indication of historic performance. Fund ratings are published monthly.

The Morningstar Style Box is a grid containing 9 squares that gives a graphical indication of the investment style of individual stocks and funds. For example, the box will indicate on its vertical axis the capitalization band that a stock falls into, while its horizontal axis will place the stock within a ‘value’ or ‘growth’ category. By determining investment styles for a large number of individual stocks it is then a simple matter to use the grid to evaluate stocks against each other.

Morningstar Premium Service:

Much of the data supplied by Morningstar is only available to Premium Service subscribers through their web site, and this is certainly a service that is worthy of consideration.

Pros:

- Provides detailed analysis for stocks and mutual funds, and gives you their own view of the pros and cons of investing in each.

- Provides details of annual returns, including dividends.

- Provides actionable analyst reports for a large number of stocks and funds.

- Provides details of stock dividends over time.

- Offers an X-Ray Tool that is invaluable when it comes to ensuring that your portfolio is properly spread in terms of stocks, sectors, country and much more.

- Offers a Cost Analyzer to help you to choose between mutual funds.

Cons:

- Morningstar’s model is based upon the principle of fundamental, or value, investing and they do not get into such things as charting, or any discussion about when you should buy or sell, from a technical standpoint.

- Morningstar’s rating system is not perhaps as accurate, or as valuable, as they would like us to believe and, while it is certainly useful, it should be used alongside other data when making any investment decision.

Conclusion:

For many people the attraction of Morningstar’s Premium Service lies in the ability to access the company’s stock ratings, style box data, and other proprietary tools, developed over more than 20 years.

Tools that analyze the performance of stocks and funds, and that provide an indication of possible future performance are widely available today, and all of them have both their supporters and critics. At the end of the day however they are simply tools designed to provide just one piece that goes to make up a complex jigsaw puzzle. In this respect, Morningstar’s rating system is as good, if not better, than many similar systems. However, as an overall package, Morningstar’s Premium Service provides some very powerful, and extremely useful, information for the fundamentalist, or value, investor.